We Offer Our Valued Clients

Funding Solutions

Get the Capital you need to launch or scale your business.

Rates as low as 0%

Get Pre Approved Today !

2 Min Application

Applying Does Not Impact Credit !

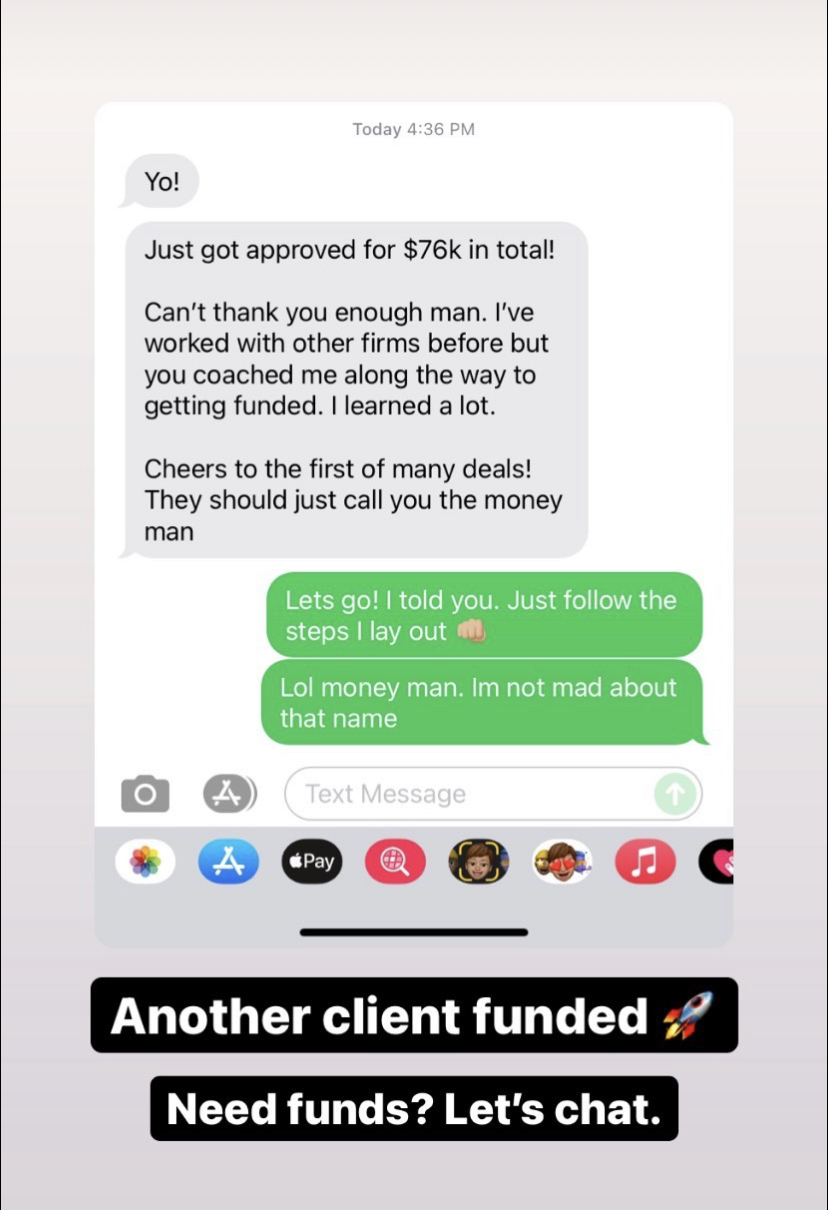

Our Clients

Testimonials

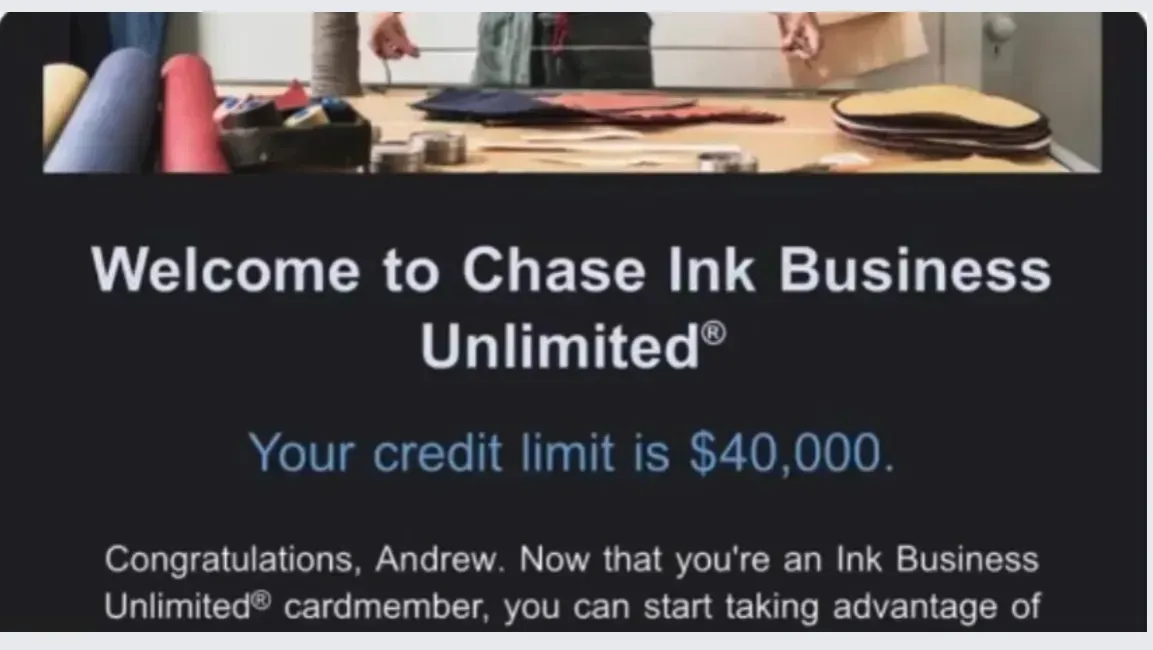

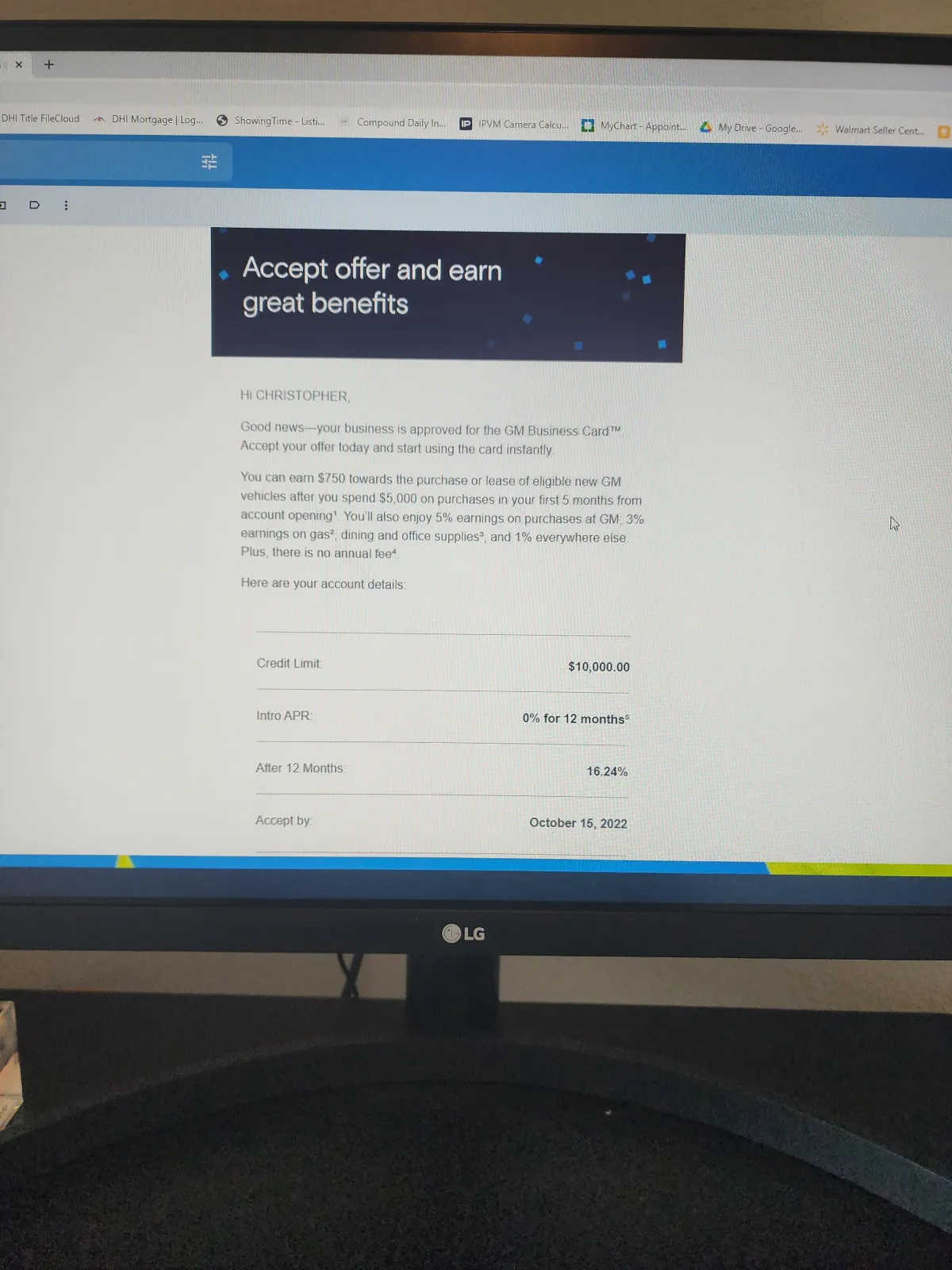

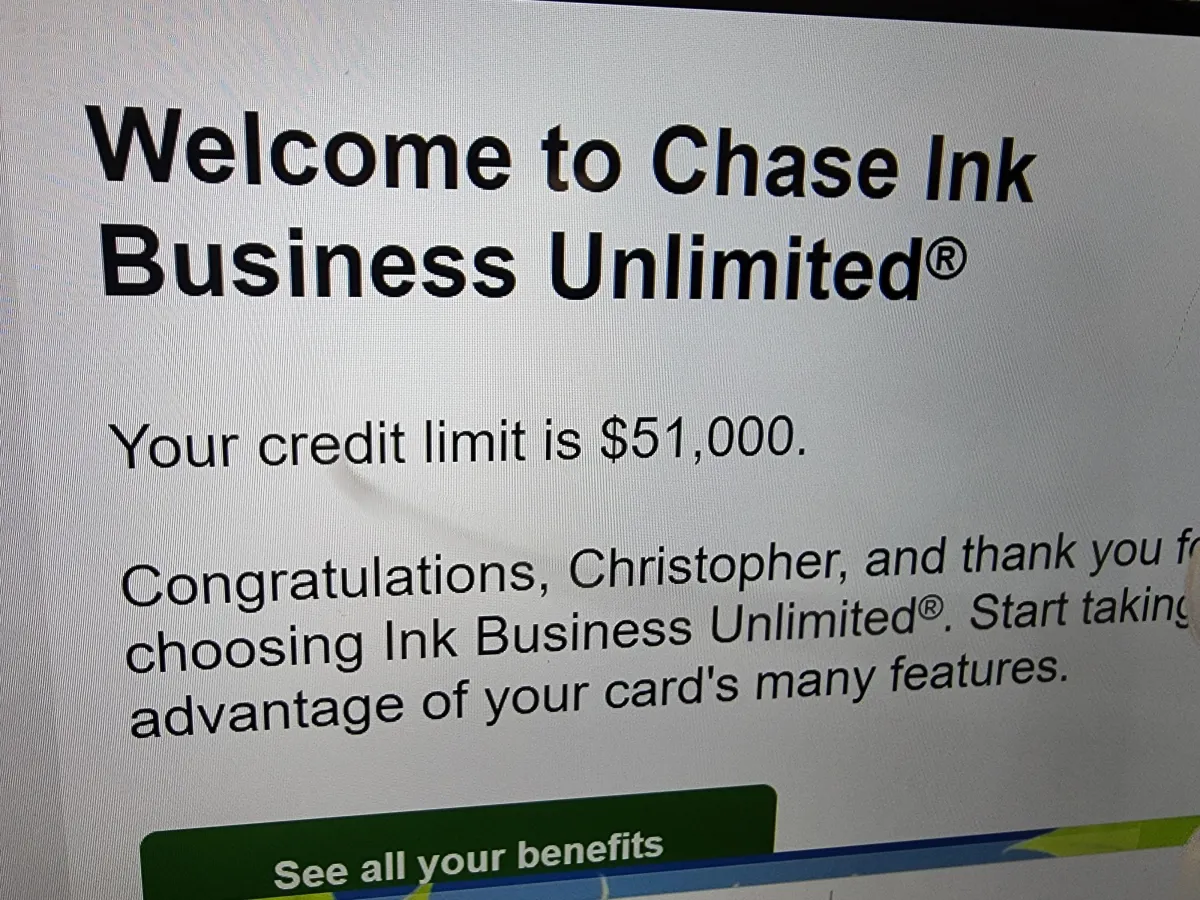

Another Chase Approval . Christopher used this funding for rehab costs on his real estate Flip.

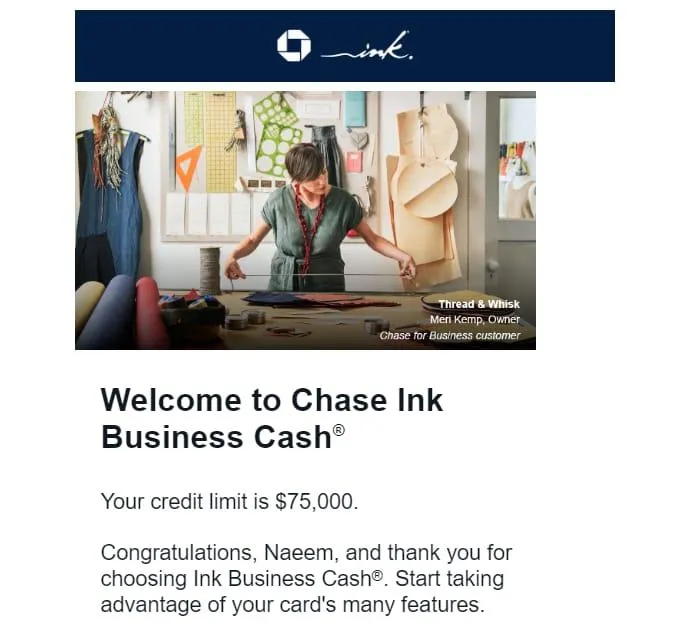

Meet Sonia,

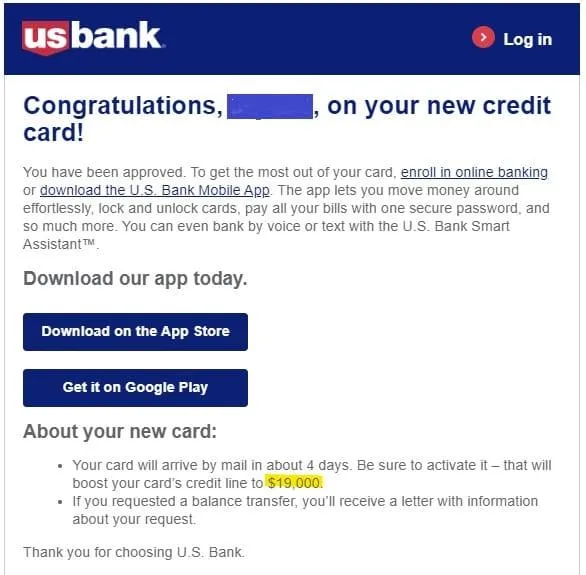

Who we prepped for funding and has now secured over 120 k in 0% funding!

Meet Tony,

Who needed a bit of help getting his already stellar credit profile to shine for lenders, He is now ready for funding!!

Our Quick & Easy

Process Explained

With The Lucky Method, You will work 1 on 1 with one of our advisors from start to cash or credit in hand on your funding Journey.

1

Website Pre - Approval Form

Please fill out the webform on our site and request your consultation appointment.

2

Phone Consultation &

Pre Approval

We schedule a no pressure call to discuss your funding goals and explain our services. We Know what the banks need to see and can Pre-Approve you based on your personal credit profile same day.

3

Funding Application & Agreement

We will send you our required funding application and agreement for you to fill and out electronically sign.

4

Funding Plan Created &

Initiated

Here is where the fun starts we create the best funding plan to achieve or exceed your goals for each client.

5

Funding In Process

We Initiate your funding Plan, This process usually takes 14-45 days with an average of 30 days.

6

Funding Received

Yeah ! The money is now hitting you bank account or you are receiving your new 0% interest business cards via mail.

We Offer Competitive Solutions to Our Clients

At Lucky Elephant Funding, we specialize in providing accessible funding solutions tailored to meet your financial needs. With a focus on 0 percent funding, lines of credit, and SBA loans, we are dedicated to helping individuals and businesses thrive by offering flexible and affordable financing options.

Our Approach

We understand that navigating the world of financing can be complex and daunting. That's why we're here to simplify the process for you. Our team of experienced professionals works diligently to guide you through every step of the funding journey, providing personalized support and expertise along the way.

Our Partnerships

Through strategic relationships with leading banks and lending institutions, we leverage our extensive network to secure the best possible funding options for our clients. These partnerships allow us to offer competitive rates and terms, ensuring that you receive the most advantageous financing solutions available.

Why Choose Us

Personalized Service: We believe in the power of one-on-one relationships. When you work with us, you'll receive individualized attention and support from our dedicated team members who are committed to helping you achieve your financial goals. Expertise: With years of experience in the industry, we have the knowledge and insight to navigate the complexities of the funding process effectively. Whether you're a first-time borrower or a seasoned entrepreneur, you can trust us to provide expert guidance and advice every step of the way. As a broker working with multiple banks and lending institutions, we offer a diverse range of funding solutions to suit your specific needs and circumstances. From 0 percent financing to SBA loans, we have the resources and connections to help you find the perfect fit for your financial requirements.

Let Us Help You Make Better Financial Decisions Our Programs

Business Line of Credit

Leverage a revolving line of credit and only pay for what you need. Access funds at your pace, as your business needs

Personal Loans

Secure up to a five-year personal loan to manage/Paydown your credit card balances, enhance your score, and qualify for 0% funding.

Short Term Business Loans

Unlock quick access to funds for any business expenses. Your solution to fast, convenient financing when time is of the essence.

0% Business Credit Stacking

Launch your business with the confidence of multiple 0% interest accounts. Enjoy cash accessibility with revolving credit at a 0% interest rate.

SBA Business Loans

Experience the reassurance of a traditional process with lower payments spread over a longer term.We also f

Asset Based Lending

Unlock the power of your company’s assets. Leverage your inventory, equipment, or receivables into the funds you need to grow.

Our Illustrious Members

We are a boutique Family run company with a laser focus on customer experience. With a combined multitude of experience in the financial and technical verticals.

Renee Silver

Founder/ CFO

Over 15 years in Corporate Finance. With a focus on business credit and finance. Renee oversees all underwiring in house and has developed banking relationships throughout the industry to secure the best and maximum funding for each client.

Chris Silver

Director Of Operations

Over 23 years in Operations and Management and IT. Chris has spent the last 7 year investing in Real estate and land and has funded several of the real estate transaction's by using 0% funding. Renee and Chris have funded their business ventures with just shy of half a million dollars.

FREQUENTLY ASKED QUESTION

How Much Funding Can I Get?

The funding opportunities we secure are influenced by various factors, such as your individual credit history, business details, and current or anticipated revenue. Typically, clients receive an initial funding range of $50,000 to $250,000. Subsequent funding rounds have the potential to exceed $500,000.

How Long Does It Take To Get Funding?

This depends on many factors, but generally, we can secure your initial funds within 14-60 Days.

How Much Does Funding Cost?

We work on a performance fee, We don't get paid unless you receive funding. We only invoice after you have received your capital.

Can I get funding on my own?

Of course, you can apply on your own, However typically you will receive denials, We have spent years developing banking relationships and have contacts at each bank and have the know how to present exactly what the banks are looking for at application, resulting in higher approvals and higher limits of funding.

Do You Need To Use My Personal Credit For The Application?

Yes. Even though you may be applying for business credit, lenders still refer to your personal credit for their decision-making.

What If I Have Bad Credit?

Yes. Even though you may be applying for business credit, lenders still refer to your personal credit for their decision-making.

Will The New Business Credit Show Up On My Personal Credit Report?

No. Typically business credit lenders report to business credit profiles, not personal ones.

How to log Into to Our client portal

Please click the link below to login - Use your email address as your user name :

https://app.coordinatehq.com/client_portal/5e60d803

Get In Touch

Assistance Hours

Mon – Fri 9:00am – 6:00pm

Sat- On Request

Sunday – CLOSED

Phone Number:

833-501-3657

Facebook

Instagram